Price Level Targeting

Feb 16, 2024 By Susan Kelly

The objective of price stability may be attained via a monetary policy framework known as price level targeting. LPrice level targeting is a method used in monetary policy in which the central bank manipulates the amount of money and credit available in the economy by either increasing or decreasing the supply of money and credit to attain the desired price level. Price level targeting may be compared with other conceivable objectives used to steer monetary policy. All of these targets are examples of what are known as nominal economic variables.

Understanding Price Level Targeting

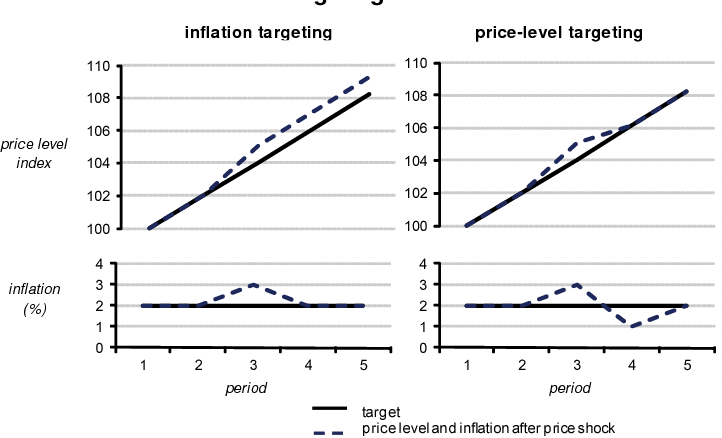

Pricing level targeting, similar to inflation targeting, involves establishing goals for a price index, such as the consumer price index (CPI). Price level targeting, on the other hand, involves setting a goal for the overall level of the index, in contrast to inflation targeting, which involves setting a growth rate for the price index. Because it does not consider previous shifts in the price level, inflation targeting may be seen as having a more forward-looking approach because it focuses only on the percentage rise in the present price level. Price level targeting implicitly takes into account previous changes in price. It commits to correcting any deviations from the previous goal by considering the current price level.

For example, if the level of prices in a given year fell below the target level for that level of prices in that year. This wouldn't be required if we were pursuing a certain inflation rate.

Theoretically, targeting prices rather than inflation is more successful than targeting inflation since the aim may be more precisely defined. However, considering the repercussions of falling short of the aim, it is a riskier strategy. If the price level that the central bank has set as its objective is exceeded in one year, it may be required to implement a contractionary monetary policy the next year to bring it back to its target level.

For instance, if a surge in oil prices causes a temporary increase in inflation, a central bank that targets price levels may need to tighten monetary policy even when the economy is in a recession. In contrast, a central bank that targets inflation may be able to look past the temporary increase in inflation and continue to focus on its primary goal of achieving its inflation target. This would be quite problematic from a political standpoint.

Price Level Targeting at the Zero Bound Interest Rate

After abandoning the gold standard in the 1930s, the Swedish central bank made its first significant effort at price level targeting, based on the ideas of another Swedish economist named Knut Wicksell. The objective of the Swedish strategy was to achieve a constant, fixed price level without experiencing either inflation or deflation. This objective was intended to serve as a stopgap measure to temporarily replicate the gold standard until international metallic monetary standard could be re-established. Later Swedish and Keynesian economists pointed the finger at this strategy for contributing to the worsening of unemployment during this period in Sweden.

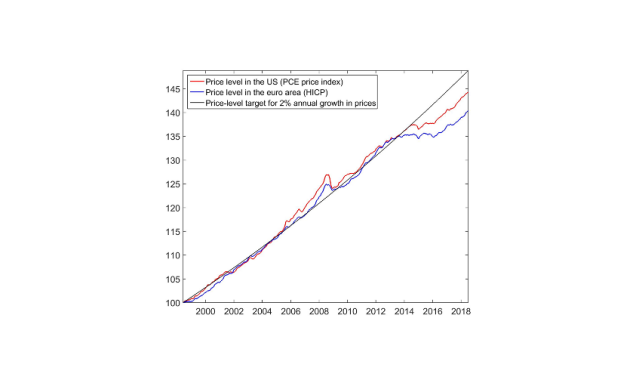

On the other hand, price-targeting has once again emerged as a subject of discussion due to the proximity of nominal interest rates to the zero limit in many nations. If inflation expectations can be maintained, a negative demand shock will cause an increase in real interest rates even when the federal funds rate is at or near the zero lower limits. If people and businesses believe that monetary policy has become powerless and their inflation expectations decline, as a result, real interest rates will climb even more, which would increase the danger of a recession.

Conclusion

In contemporary macroeconomic models, it has been discovered that price-level targeting is an effective strategy for assisting the economy in recovering from deflationary shocks that have driven monetary policy to zero limits. It achieves this because price-level targeting indicates that future inflation will be enhanced when such shocks occur, and as a result, real interest rates are dropped. In addition, this approach would make it possible to minimize trend inflation, providing extra advantages if it were to be implemented. These advantageous impacts are critically dependent on the framework of New Keynesian models and reasonable expectations.

The body of empirical research that we have reviewed does not refute these hypotheses and, instead, supports the use of logical expectations rather than behavioral ones. As a result, we have concluded that in the future, policymakers should continue to pay attention to price-level targeting.

The Risks of Investing in Individual Stocks

Investing in individual stocks can be risky due to the unpredictable nature of the stock market. Learn why investing in individual stocks is not suggested.

Dec 07, 2023 Triston Martin

IRA Club Review 2024: Trusted Financial Facilitator

This article will provide a detailed IRA Club review to discuss how it can be your facilitator to invest wisely.

Mar 15, 2024 Triston Martin

Deciphering the Priority of Student Loan Repayment: A Comprehensive Overview

This resource provides invaluable insights into the importance of prioritizing student loan repayment, strategies for efficient debt management, and comprehensive information about various repayment options.

Nov 02, 2023 Triston Martin

IRS Publication 15: The Tax Guide for Employers

Known as Employer's Tax Guide, Internal Revenue Service Publication 15 outlines an employer's obligations concerning tax data filing and reporting. This article will discuss how employers and employees may work together to deduct, deposit, report, pay, and amend taxes. Circular E is another name for IRS Publication 15, also known as Publication 15.

Feb 10, 2024 Triston Martin

Unraveling Personal Loans: A Comprehensive Guide to Financial Freedom

Curious about personal loans? Explore the financial universe with our guide on the pros and cons of personal loans, unlocking insights to help you make informed decisions.

Nov 30, 2023 Triston Martin

What are the taxes on a 401(k) distribution?

Learn the basics of understanding and calculating your taxable income from a 401(k) distribution. Get expert tips on how to reduce your tax liabilities

Nov 22, 2023 Susan Kelly